Welcome to

Astound Tax Solutions

Your trusted partner in navigating the complexities of taxes and financial planning.

What You Need to Know Before Filing or Fixing Your Finances

Quick, easy-to-read blocks of info:

📅 When to File: Deadlines, extensions, and why early filing matters

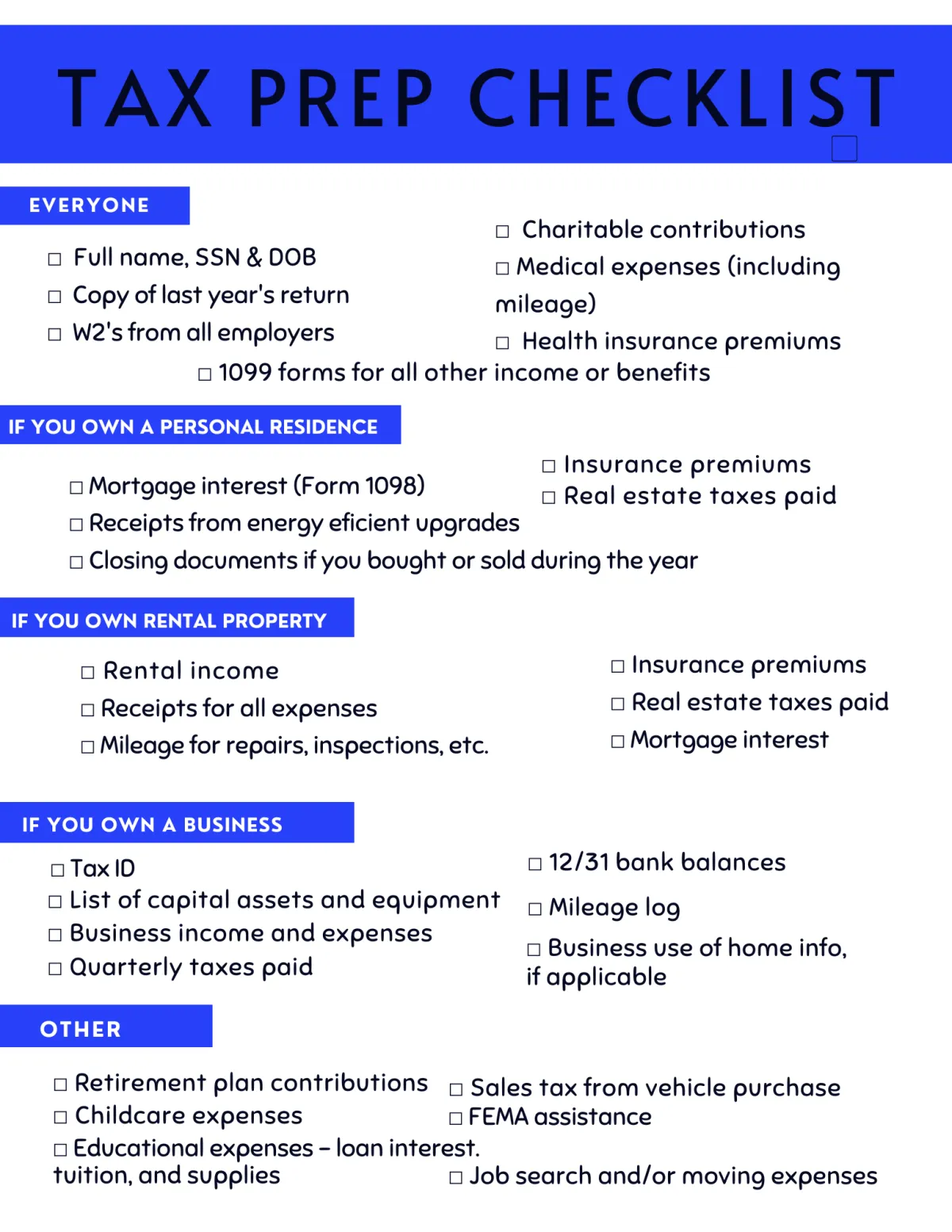

🧾 What You Need: List of documents needed for tax prep

💰 Advance Loans: How they work + who qualifies

💳 Fixing Credit: Common myths vs. facts about credit repair

🧠 Business Tax Tips: What self-employed or small biz owners must know

Services Overview: How We Assist You

Expert solutions for your tax preparation and financial strategy needs.

Tax Preparation & Filing

Individual Tax Returns – Maximize your refund while staying IRS-compliant.

Business Tax Returns – Expert strategies for LLCs, corporations, and sole proprietors.

Amended Tax Returns – Fix previous filings and recover missed refunds.

Tax Resolution Services

IRS Debt Relief & Payment Plans – Stop wage garnishments and settle IRS debts.

Audit Representation – Experienced guidance if the IRS comes calling.

Financial Solutions

Refund Advance Loans – Access up to $6,000 with no out-of-pocket fees.

Bookkeeping & Payroll – Stay organized and compliant with our full-service accounting.

🧾 What You Need to File

Before your appointment, grab:

✅ Photo ID (and spouse's if filing jointly)

✅ Social Security cards or ITINs

✅ W-2s, 1099s, or income forms

✅ Last year’s tax return (if available)

✅ Proof of expenses (if self-employed)

✅ Dependent info + childcare records

✅ Bank info for direct deposit

💡Tip: Keep digital or printed copies organized—less stress, faster filing.

💰 Advance Loans

Need cash before your refund drops? We got you.

With our Taxpayer Advance Loans, you could receive up to $7,500 within 24–48 hours after your return is accepted. (When available)

✅No credit check

✅ Approval based on your refund

✅ Paid back automatically when the IRS releases your refund

💬 Ask us if you qualify during your appointment.

Testimonials

Jannief M.

Really impressed with Astound Tax Solutions. Their individual tax prep caught errors I missed, and the IRS representation sorted out my audit stress-free. Highly recommend!

Candie M.

Switched to Astound after trying others; their business tax planning is top-notch, and having IRS representation really takes the stress out of audits.

James K.

Astound's tax consulting has streamlined my planning. Very straightforward advice, definitely eases the financial decision-making process year-round.

FAQs

Answers to Your Most Pressing Tax Preparation Queries

How can Astound Tax Solutions assist if Ive been doing my own taxes

We review past filings, suggest improvements, and manage future processes for better accuracy and savings.

What kind of tax issues can you handle for businesses?

We handle a range of business tax needs from basic filing to complex issues like cross-state taxation, international tax obligations, employee tax, and more. We also offer comprehensive support for startups to establish robust tax strategies from the beginning.

What should I bring to my first consultation?

Bring previous tax returns, documents of income, records of expenses and deductions, and any IRS notices.

How do you ensure confidentiality and security of personal financial information

We use industry-standard security measures to protect all client data, both physical and electronic. All client information is treated with strict confidentiality and is only used as necessary to provide requested services.

How is your fee structure determined?

Our fees are based on the complexity of the tax situation and the type of service provided. During your initial free consultation, well provide an estimate that reflects your specific needs without hidden charges.

Do you provide support throughout the year or only during tax season?

We provide year-round support including mid-year reviews and ongoing advisory services.