YOU SHOULD KNOW: IRS UPDATES & TAXPAYER CHANGES (2025)

Don’t Wait Until the Last Minute to File Your Taxes

Filing early helps you:

✅ Avoid refund delays — Get your money faster.

✅ Prevent identity theft — Beat the fraudsters to your return.

✅ Plan ahead — Know what you owe and avoid last-minute panic.

IRS & Taxpayer Updates – Mid‑2025

One Big Beautiful Bill Act (OBBBA) – Effective July 4, 2025

Standard deduction rises:

$15,000 for singles (↑$400), $30,000 for married filing jointly (↑$800), and $22,500 for heads of household .

Seniors (65+) get an extra $6,000 bonus deduction, plus regular senior deduction—potential total: $23,750 (single) or $46,700 (joint).

Tip & overtime deductions:

Up to $25,000 of cash tips and $12,500 of overtime pay deductible (2025–2028); subject to income phase-outs ($150k single, $300k joint).

Expanded itemized deductions:

SALT cap temporarily raised to $40,000 (reverts lower after 2029).

Child Tax Credit growth:

Increases to $2,200 per child in 2025, continuing many 2017 TCJA provisions.

Energy & EV credits updated:

Includes new clean energy incentives and adjustments under the Act.

IRS Inflation Adjustments for 2025 Returns

Earned Income Credit (EIC):

Max rises to $8,046 for filers with 3+ qualifying children.

Inflation adjustments

For tax year 2025 – The annual inflation adjustments for tax year 2025. Revenue Procedure 2024-40 provides detailed information on adjustments and changes to more than 60 tax provisions that will impact taxpayers when they file their returns in 2026.

For tax year 2024 – The annual inflation adjustments for more than 60 tax provisions for tax year 2024, including the tax rate schedules and other tax changes. Revenue Procedure 2023-34 provides detailed information about these annual adjustments.

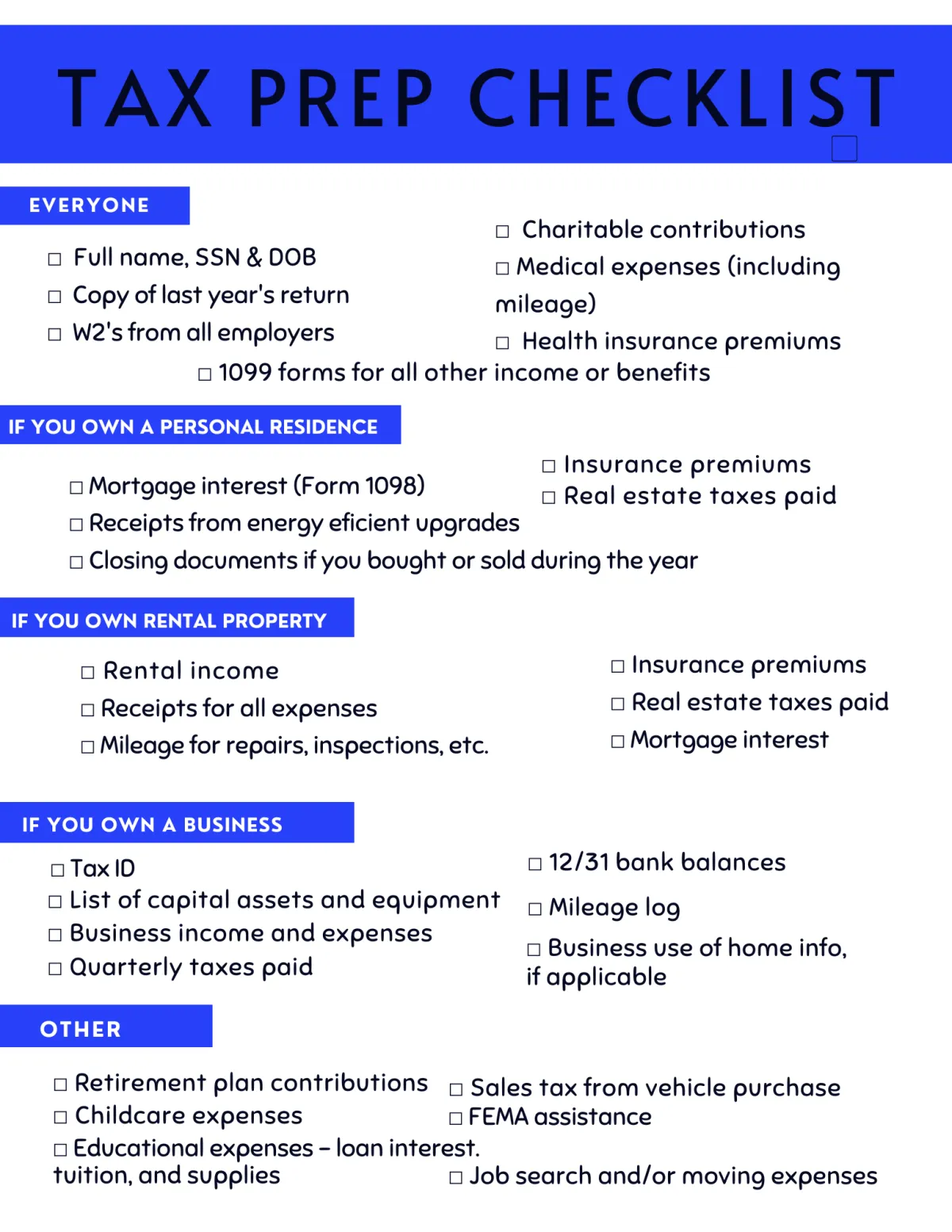

🧾 What You Need to File

Before your appointment, grab:

✅ Photo ID (and spouse's if filing jointly)

✅ Social Security cards or ITINs

✅ W-2s, 1099s, or income forms

✅ Last year’s tax return (if available)

✅ Proof of expenses (if self-employed)

✅ Dependent info + childcare records

✅ Bank info for direct deposit

💡Tip: Keep digital or printed copies organized—less stress, faster filing.

Filing Season & Free File Programs

Tax season began Jan 27, 2025, with a large share of returns e‑filed; about 140 million expected.

IRS Direct File permanent expansion:

Available in 25 states for simple returns, includes more credits—now free for many filers.

IRS Free File remains available for those under $84k AGI.

Commission may eliminate Direct File, replacing it with public-private filing service—still under reconciliation.

IRS Staffing & Service Improvements

Workforce dropped ~26% since January—now under 76,000 employees—raising service delays.

New IRS Commissioner: Billy Long confirmed June 12, sworn in June 16, 2025 .

Improvements in business pre‑filing programs and transition relief for digital asset reporting (Form 1099‑DA).

Tax Relief & Identity Support

April 15 deadlines extended for disaster‑affected states (CA wildfires, Missouri, Tennessee, WV, etc.).

IRS encouraging use of online tools over phone due to staffing reductions .

Continued rollout of digital asset reporting relief and identity assistance.

Testimonials

Jannief M.

Really impressed with Astound Tax Solutions. Their individual tax prep caught errors I missed, and the IRS representation sorted out my audit stress-free. Highly recommend!

Candie M.

Switched to Astound after trying others; their business tax planning is top-notch, and having IRS representation really takes the stress out of audits.

James K.

Astound's tax consulting has streamlined my planning. Very straightforward advice, definitely eases the financial decision-making process year-round.

FAQs

Answers to Your Most Pressing Tax Preparation Queries

How can Astound Tax Solutions assist if Ive been doing my own taxes

We review past filings, suggest improvements, and manage future processes for better accuracy and savings.

What kind of tax issues can you handle for businesses?

We handle a range of business tax needs from basic filing to complex issues like cross-state taxation, international tax obligations, employee tax, and more. We also offer comprehensive support for startups to establish robust tax strategies from the beginning.

What should I bring to my first consultation?

Bring previous tax returns, documents of income, records of expenses and deductions, and any IRS notices.

How do you ensure confidentiality and security of personal financial information

We use industry-standard security measures to protect all client data, both physical and electronic. All client information is treated with strict confidentiality and is only used as necessary to provide requested services.

How is your fee structure determined?

Our fees are based on the complexity of the tax situation and the type of service provided. During your initial free consultation, well provide an estimate that reflects your specific needs without hidden charges.

Do you provide support throughout the year or only during tax season?

We provide year-round support including mid-year reviews and ongoing advisory services.