Welcome to

Astound Tax Solutions

Your trusted partner in navigating the complexities of taxes and financial planning.

Get You Quote Now

Other useful Estimate Calculators

Self employed?

Self-Employment Tax & Write-Off Estimator (Astound)

EITC/CTC Estimate Calculator

Financial Solutions

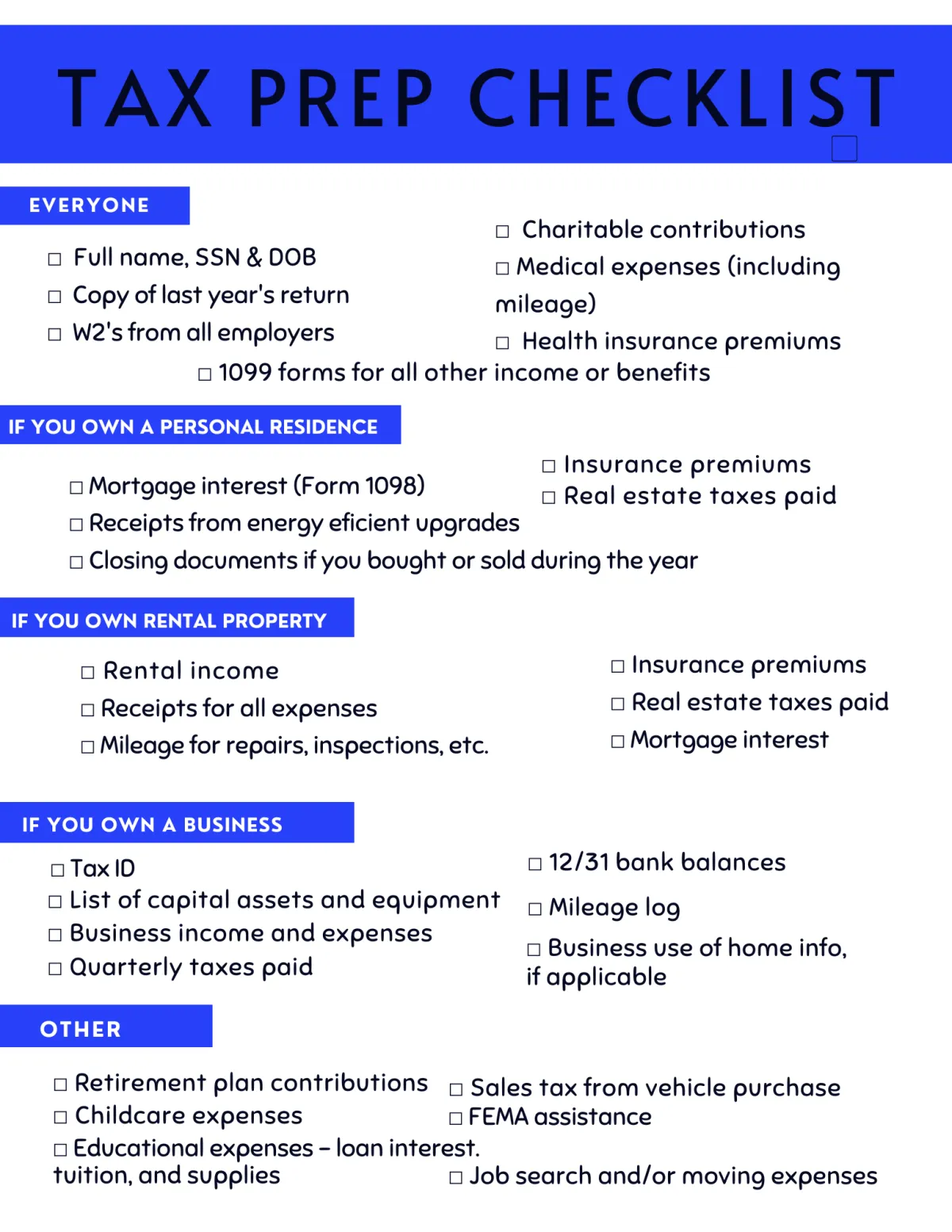

🧾 What You Need to File

Before your appointment, grab:

✅ Photo ID (and spouse's if filing jointly)

✅ Social Security cards or ITINs

✅ W-2s, 1099s, or income forms

✅ Last year’s tax return (if available)

✅ Proof of expenses (if self-employed)

✅ Dependent info + childcare records

✅ Bank info for direct deposit

💡Tip: Keep digital or printed copies organized—less stress, faster filing.

Testimonials

Jannief M.

Really impressed with Astound Tax Solutions. Their individual tax prep caught errors I missed, and the IRS representation sorted out my audit stress-free. Highly recommend!

Candie M.

Switched to Astound after trying others; their business tax planning is top-notch, and having IRS representation really takes the stress out of audits.

James K.

Astound's tax consulting has streamlined my planning. Very straightforward advice, definitely eases the financial decision-making process year-round.

FAQs

Answers to Your Most Pressing Tax Preparation Queries

How can Astound Tax Solutions assist if Ive been doing my own taxes

We review past filings, suggest improvements, and manage future processes for better accuracy and savings.

What kind of tax issues can you handle for businesses?

We handle a range of business tax needs from basic filing to complex issues like cross-state taxation, international tax obligations, employee tax, and more. We also offer comprehensive support for startups to establish robust tax strategies from the beginning.

What should I bring to my first consultation?

Bring previous tax returns, documents of income, records of expenses and deductions, and any IRS notices.

How do you ensure confidentiality and security of personal financial information

We use industry-standard security measures to protect all client data, both physical and electronic. All client information is treated with strict confidentiality and is only used as necessary to provide requested services.

How is your fee structure determined?

Our fees are based on the complexity of the tax situation and the type of service provided. During your initial free consultation, well provide an estimate that reflects your specific needs without hidden charges.

Do you provide support throughout the year or only during tax season?

We provide year-round support including mid-year reviews and ongoing advisory services.